[5]

[5]

Josh Lehner

Oregon Office of Economic Analysis

It has been our office’s view that what matters most for labor supply is total household income. If you have the financial cushion to not work given *gestures at everything* then some individuals will choose not to do so. Initially federal aid kept households afloat financially during a global pandemic. One result of the federal aid was that households built up a tremendous amount of excess savings. Expectations were, and continue to be that as those savings are spent, more workers will return to the labor market as they need to pay the bills and put food on the table. I remain a labor supply optimist.

It felt like much of the economic discourse earlier this year focused almost solely on the UI benefits. While clearly those are a big piece to the puzzle, they are not the only piece as our office has noted [6] previously. The good news is this broader look at incomes is now coming into focus a bit more. See this really good Twitter thread [7] from the NYT’s Ben Casselman for example. While it’s good the conventional wisdom is catching up, it’s also important to note that the story continues to evolve further.

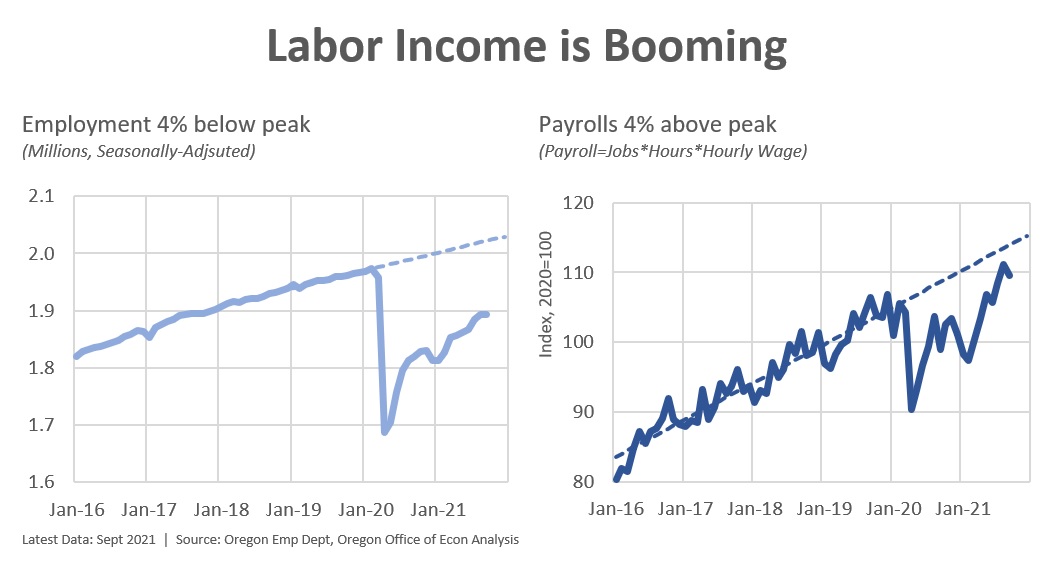

In particular, labor income is booming. Underlying wage growth is taking the lead from the expiring federal aid. However this growth is happening among a smaller pool of workers than before. They are working longer hours and at higher pay. As shown below employment in Oregon is 4% below pre-COVID peaks and 6% below trend. However labor income is 4% above peak, and nearly back to trend. Payrolls have fully recovered even if employment has not.

Why does this matter and what are the implications? Well, for starters it means household savings are not being drawn down as much as anticipated even a few months ago. This is especially the case for households where at least one adult is working. The implications are that a second adult may not have to return to the workforce as quickly as expected given the income gains from the one earner plus the savings built up during the pandemic. In fact if you look at the latest survey [8] from Indeed it shows the main reason job seekers are not urgently looking for work has shifted in recent months from COVID fears to financial cushion to spousal employment.

It’s important to keep in mind that the overall economic outlook remains bright. Strong household finances mean consumer demand is robust. But while it is encouraging that the economic discussion has shifted to focusing on total household incomes, the actual story continues to evolve. This payroll piece is newer in the sense that in aggregate it’s really starting to move the needle. Withholdings here in Oregon remain very strong. It also means that the risks that labor supply will take a few more months to fully return have increased. Our office’s view continues to be that the labor market will improve. Workers will return given job opportunities are more-plentiful and better-paying than before the pandemic, and as savings are drawn down. Even so the labor market will remain tight for structural and cyclical reasons, it just won’t be acutely tight.

Note that nationally the data show both strong hourly wage gains and a longer workweek, while the Oregon numbers show a steady workweek but even stronger hourly wage gains. The data can be noisy and we may have to wait for future benchmarks or revisions, but either way aggregate payroll growth is very strong