[5]

[5]

Tim Duy

University of Oregon State of Oregon Economic Indicators

Below is the University of Oregon State of Oregon Economic Indicators for March 2021. The release date is June 8, 2021. Special thanks to our sponsor, KeyBank.

Link to full report (with charts!) here [6].

The Oregon Measure of Economic Activity, a measure of the strength of growth, fell to -0.10 in April while the University of Oregon Index of Economic Indicators, a measure of the direction of the economy, rose again in April. Highlights of the report include:

– The Oregon Measure of Economic Activity fell to -0.10 in April from 0.58 in March. The moving average measure, which smooths out the monthly volatility, was 0.30 where 0.0 is the average pace of growth since 1990; currently, Oregon’s economy is growing at an above average pace.

– Only the household sector made a positive contribution to the measure of activity; weak or negative employment growth, particularly in the manufacturing component, weighed down the other sectors.

– The slow pace of job growth likely reflects supply side constraints rather than demand side weakness. Labor supply appears to be constrained by a variety of factors, including enhanced unemployment benefits and childcare issues. These constraints should ease somewhat later this year.

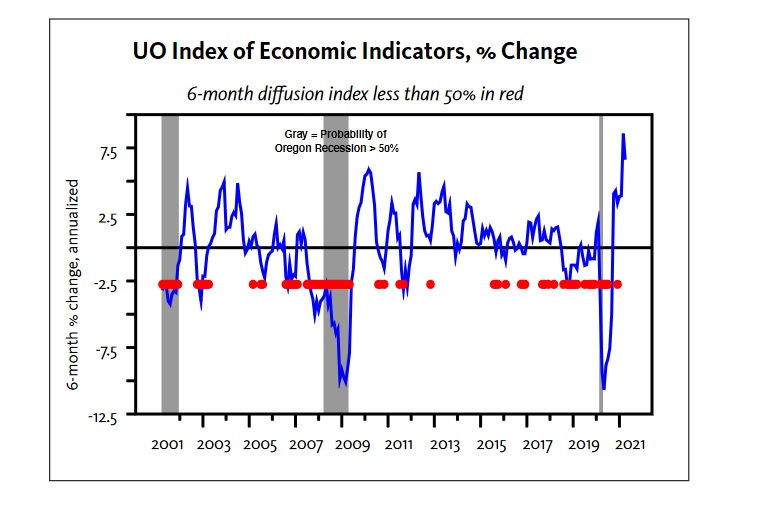

– The University of Oregon Index of Economic Indicators rose again in April, the fifth consecutive solid gain. Most components improved during the month.

– Initial unemployment claims edged up and still remain high relative to the pre-pandemic period; claims should fall in the months ahead. Employment services payrolls, mostly temporary help, made a strong gain as employers scramble for labor.

– Housing units permitted (smoothed), the weight distance tax (a measure of trucking activity), and the new orders for core-capital goods all rose substantially and indicate a strong cyclical rebound. Manufacturing hours worked, however, fell modestly. This indicator was weak prior to the pandemic; the weakness may be attributable to structural change in the manufacturing sector that makes comparisons to the past difficult. Consumer confidence edged higher.

The economy is rebounding quickly from the pandemic recession. Progress should continue as the pandemic comes under greater control and more restrictions on activity lifted.