[5]

[5]

By Josh Lehner,

Oregon Office of Economic Analysis [6]

Many of the business discussions surrounding beer tend to focus on the number of breweries opening or closing. We use that as a barometer for the health of the sector, including our previous look at industry dynamism. Counting breweries is pretty easy, however it also provides an incomplete picture. The volume of beer produced matters, and what that says about consumer demand for the product. Between the Brewers Association and the OLCC beer reports, we can get a decent look at barrels of beer produced nationwide and here in Oregon. What follows below is a quick look at breweries in Oregon where we are able to measure both the number of breweries and how much beer they are producing that is sold in the state.

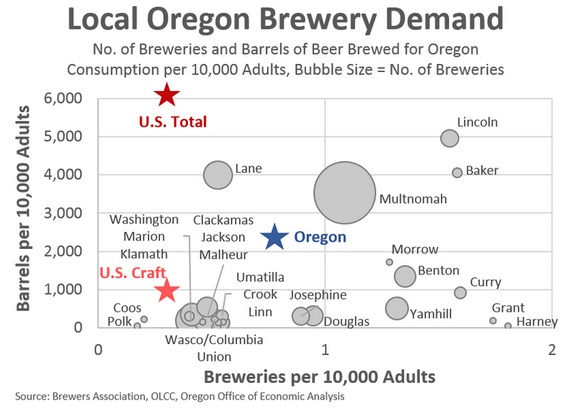

As of the start of the year, 32 of Oregon’s 36 counties has an operating brewery. And 30 of these counties have more breweries per capita than the U.S. average. That said, the picture shifts a bit when we take into account how much beer these breweries are actually producing. Just 5 Oregon counties produce more local beer per capita than the U.S. average, however if we focus only on craft beer nationwide and ignore the macro, then 11 Oregon counties outpace the nation.

To me, this speaks to the skewed distribution of brewery production. Focusing just on the beer brewed and sold in the state by Oregon breweries, the 8 largest ones account for half of the total, while the Top 20 account for 75%. I suspect similar patterns are seen elsewhere in the country, where a handful of large breweries account for the majority of sales.

Now, there are a couple ways to look at this. On one hand, the typical brewery in Oregon brews around 500 barrels per year while the average is 3,300. Most breweries in Oregon are small or at least smaller-scale operations. However, on the other hand, a lot of seemingly successful brewpubs are generally in that 400-700 barrels of beer range, using my eyeball econometrics. And I think this is where Oregon has stood out over time. Yes, the state is home to a handful of large, successful breweries with wide-ranging distribution networks. However, the state’s above average number of breweries per capita is all about the hundreds of smaller breweries and brewpubs.

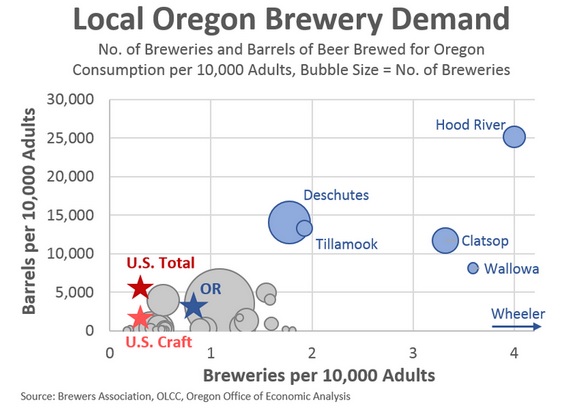

With that said, let’s look at two charts showing county level data in Oregon. First up we can see that the usual suspects stand out in terms of local breweries relative to local population. Hood River (think pFriem, Full Sail, Double Mountain, et al) has 13 times the US average for breweries per capita and nearly 25 times the volume of craft beer produced. Both Deschutes (think Deschutes, 10 Barrel, Boneyard, Crux, Sunriver, et al) and Clatsop (Fort George, Buoy,) are in the 10-15 times the U.S. craft beer average of production, with Tillamook (Pelican) and Wallowa (Terminal Gravity) not far behind. Of course — and this is a topic I’ll return to later in this occasional series — not all of this beer is sold within these counties. These larger breweries sell across the state and also serve as tourism hubs for out-of-town folks visiting, tasting, and going out to eat.

The second chart zooms in on the bulk of the counties to get a clearer picture. Here you can really see that while nearly all Oregon counties have more breweries than the national average, they’re really not producing a ton of beer relative to the local population.

When I’m asked about whether Oregon has too many breweries, my answer is generally no in the context of looking at these local production numbers relative to the local population. Given that most counties are below the U.S. average, I suspect we could see more successful brewpubs, or production breweries with food carts or the like open up in many places. Right now, the number of breweries are equivalent to 5% of all food service establishments across the state. The true number is somewhat lower, but I do not have a good grasp of which breweries do and do not have food options. But the point being, in most communities across the state, this is not a saturated market.

That said, the concern, and one we’re seeing play out locally and nationwide, is that the growth of local, smaller breweries are taking some of the sales that previously went to the larger breweries with bigger distribution. As such, at least to some degree, if Oregon were to see increased brewery production in counties in the second chart, it may come at the expense of the outlier counties in the first chart.