Oregon Office of Economic Analysis [6]

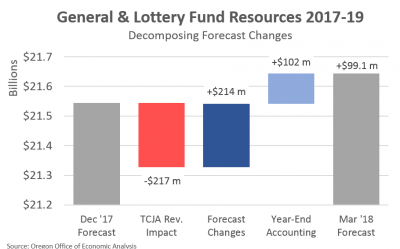

Since our office released the March 2018 economic and revenue forecast, we’ve been involved in numerous discussions about how exactly the forecast has evolved in recent months. In particular, how did the forecast go from seeing a hit to near-term revenues due to the impacts of the federal Tax Cuts and Jobs Act (TCJA) to actually showing higher total resources? What follows is an effort to clarify the underlying, and offsetting changes to the outlook.

It should be noted that there is a reduction in expected state revenues in 2017-19 from TCJA mostly due to the quirk in Oregon law related to repatriation, the bonus depreciation or expensing, and the 20% pass-through deduction. However, these declines have essentially been offset by four other forecast changes, as seen in the dark blue bar below. Year-end accounting, which includes unspent allocations from the previous biennium, increases total available resources via a larger beginning balance for the budget.

The four major forecast changes are as follows:

First, there are changes to other revenues beside personal and corporate taxes. The Lottery forecast has been raised, as have other General Fund revenues on net. Additionally there was a timing adjustment/shift made to better reflect when Rainy Day Fund transfers are actually made. In total these changes amount to approximately $40 million.

Second, the macroeconomic impacts of TCJA work to raise near-term revenues due to a somewhat stronger economy. As discussed in our report, and in our presentation to policymakers, this impact may not be huge for a variety of reasons, but it is still positive. More economic activity translates into higher tax collections, everything else being equal. However, tax cuts do not pay for themselves.

Third, behavioral changes on the part of taxpayers are likely to move the needle more than will economic feedback. The TCJA gives preference to certain taxpayers and activities while increasing the burden on others. There will be a considerable amount of tax planning as taxpayers adjust to the provisions of the bill. Changes in the timing of tax payments are already evident, with changes in filing status expected to follow next year. Some workers and investors could choose to file as businesses. Also, some businesses could benefit by changing from pass-through entities into C-Corporations, or the other way around.

One behavioral response that is assumed to have a large revenue impact is the secondary effect of multinational repatriation. After multinationals have brought their deferred income back home, and paid state and federal taxes on it, what will they do with it? Will they continue to sit on it? Reinvest it in the business here or abroad? During the repatriation holiday in 2004, more than half of repatriated income was returned to individual shareholders. Although the size of the impact is uncertain, Oregon investors will be paid more taxable dividends and see more taxable capital gains from stock buybacks. While not much economic impact should be expected from this, it will raise personal income tax collections.

Fourth, the forecast is raised in large part due to tracking. Actual revenue collections have come in approximately $400 million higher than our previous outlook. The key question here is how much of this increase is due to a stronger economy and how much is due to taxpayer behavior and shifting the timing of payments to get ahead of federal changes. As seen below, once it became clear that TCJA would become law, estimated payments soared here in Oregon, and across the country as well. Our office expected some growth this year, however not $225 million in growth relative to last year. Withholdings show a similar pattern, albeit not quite as dramatic.

If this is simply a timing shift, then higher collections today will result in smaller final payments and larger refunds during this tax filing seasons and the next as well. The forecast would remain on track, but the timing of collections would be off. However, some of these increases likely reflect a better economy. As such our office has built in some stronger real gains as a result. In fact, our office’s concerns today are mostly upside risks to the near-term outlook.

Finally, when it comes to the timing shift and why or how much taxpayers changed behavior, Mark went so far as to call some of these changes the Lehner Theory. Now, I had to correct the record to explain the language used when discussing these trends, but our friends in the CFO office went ahead of created the image below to memorialize the discussion. Obviously, I think it sums up that part of the testimony properly.

Bottom Line: The Tax Cuts and Jobs Act does reduce Oregon’s near-term tax collections for a variety of reasons. However, due to other forecast changes, a stronger near-term economic outlook, larger dividend payments and stock buybacks, revenues tracking above expectations, and year-end accounting changes, Oregon’s General Fund resources are now expected to be modestly above our office’s previous forecast. Beyond this biennium, the outlook has largely been lowered somewhat. The structural budget gap of expenditures increasing faster than our office’s revenue forecasts remains in place.