Supply Side Constraints

by Josh Lehner

Oregon Office of Economic Analysis [6]

Economic growth has firmed and the expansion continues. As the aftermath of the oil bust recedes, there are not many leading indicators today keeping economists up at night. However that does not mean there are not issues to watch. In fact, the challenges the U.S. economy faces will change as we enter into a different phase of the business cycle. Moving forward, the U.S. economy will begin to hit supply side constraints. While some economists, including the Fed, believe we are already at or beyond full employment, the consistent low levels of inflation in recent years are likely evidence that supply constraints are not holding back economic growth yet. Price pressures have yet to build. How exactly the economy adjusts to reaching some of its current limits, and how the newly reconfigured Federal Reserve reacts are key questions. The answers may go a long way toward determining how long the current expansion lasts.

Now, which supply side constraints will bind the hardest can be challenging to identify in advance. What follows is an effort to think through and sort out which constraints are more likely to be challenges sooner than others. Specifically, the lack of credit availability, labor, new technologies (productivity), and production capacity look to be potential issues in the near future. On the other hand, supply constraints like the lack of raw materials or energy, inadequate infrastructure, or deteriorating international trade relations hurting the global supply chain may be less likely to restrain economic growth in the near-term, however they do remain risks worth watching.

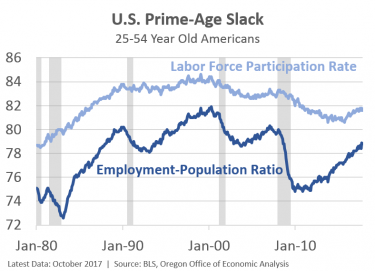

Among the more likely candidates, labor, or the supply of workers is the most obvious. While the unemployment rate itself may be lower than the Federal Reserve’s estimate of the natural rate, it is an imperfect measure. The fact that participation rates remain lower today than in the 1990s and 2000s, even with demographic adjustments, suggest some slack remains. More-plentiful job opportunities for better-paying jobs will bring workers back into the labor market. Currently job openings are at all-time highs and wages continue their slow upward movement, albeit it fits and starts. As such, workers are coming back.

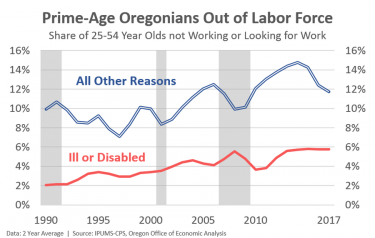

Putting another couple percentage points of prime-age Americans back to work is a reasonable, even minimal baseline outlook. This would match what the U.S. experienced in the mid-2000s. Oregon is already at this point today. However, beyond this you begin to run into larger, longer-run trends that may be harder to reverse. In particular, the rise of those out of the labor force due to illness or disability stands out. Reintegrating these individuals into the labor market is a very important challenge, not just from a labor perspective, but also for the public health and societal benefits that would come with it. A tight labor market will aid this cause considerably.

Additionally, when labor is tight, firms must dig a bit deeper into the resume stack to fill positions. Businesses must be willing to hire candidates with an incomplete skill set, or the long-term unemployed, or those with a gap on their resume. Firms may also compete not just on price (wages) but also on nonpecuniary benefits such as flexible working hours and the like. Similarly, for businesses looking to hire, on-the-job training for those with an incomplete skill set becomes more important in a tight labor market. Overall, the U.S. is not lacking for warm bodies to fill positions. The prime working-age population is growing. It is about attracting workers to fill needs and ensuring the workforce has the skills, or is able to obtain the skills needed.

Other supply constraints likely to impact the economy are the low levels of new business formation and weak productivity growth. Economists are well aware of these trends, but lack a consensus on what is causing these issues, let alone identifying solutions to propel future growth.

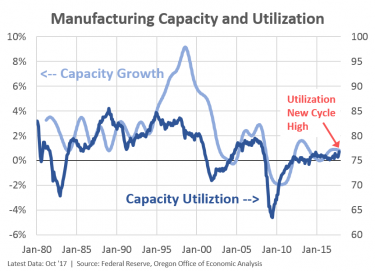

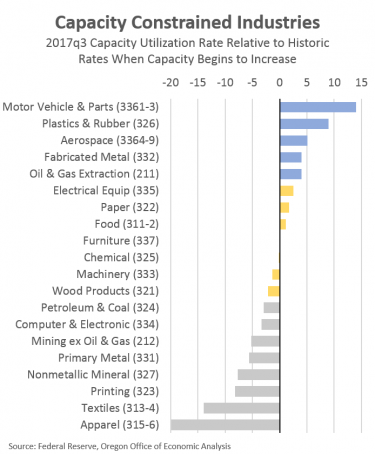

Furthermore, while overall industrial capacity utilization remains lower due to the energy sector and oil bust, total manufacturing capacity utilization recently hit a new cycle high. Absent business investment in new facilities and technologies, manufacturers may run out of room to grow sooner rather than later. Industries that are bumping up against capacity include motor vehicles and parts, plastics and rubber, aerospace, and fabricated metal. All other industries look to have some room for additional expansion before new production capacity is likely needed. Over the medium- or long-term the economy desperately needs these new investments, however the path from short-term bottlenecks to long-term economic gains may not be smooth.

Lastly, the lack of market information, or lack of confidence more generally can act as a supply side constraint as well. For businesses reaching capacity today, they need to either hold steady, which slows economic growth, or believe strongly enough in future growth that the firm will bear the risk of making long-term investments. Unfortunately, consumer or business surveys are noisy and typically bear little explanatory power in predicting future growth. However, the ongoing expansion is finally resulting in a tighter labor market and the benefits that come with it, like rising household incomes and falling poverty rates. These domestic gains, coupled with a revived international economy should indicate to firms that even though it took nearly a decade following the financial crisis, the underlying economic demand is there. The U.S. economy is entering into a new phase of the business cycle; one it hasn’t seen in quite some time. Let’s see how firms and policymakers adjust.