American Voters Want Consumer Protection Without Hurting Jobs and Main Street

— Six State Polls Show Unease With Consumer Financial Protection Agency

By U.S. Chamber of Commerce [5]

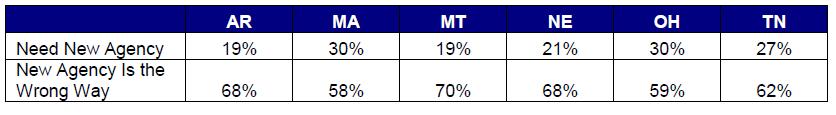

WASHINGTON, D.C.—The U.S. Chamber of Commerce today released six state polls showing that American voters overwhelmingly oppose the creation of a new Consumer Financial Protection Agency (CFPA). The polls, conducted in Arkansas, Nebraska, Ohio, Montana, Tennessee, and Massachusetts, show a significant majority of voters believe “we should demand that existing agencies do their jobs, improve enforcement, and better coordinate their efforts,” rather than create a new agency. The polls were conducted by Ayres, McHenry & Associates from April 11 to 15 and had margins of error of plus or minus 4.0% to 4.9%.

[6]

[6]

“The message is clear—Americans want Congress to get regulatory reform right. Voters don’t agree that the best way to protect consumers is by creating a $410 million federal agency with unprecedented and unchecked powers,“ said David Hirschmann, president and CEO of the Chamber’s Center for Capital Markets Competitiveness (CCMC). “We need to improve consumer financial protection—not by layering on top of the seven agencies that already have responsibilities in this area.”

Nearly three-fourths of all respondents want the CFPA to be led by a bipartisan commission instead of a single director appointed by the president, as proposed in Chairman Dodd’s version of the financial reform legislation. Between 50% and 60% are concerned that Congress will rush through a bill without getting bipartisan agreement on important changes. The poll also shows that Independents in these states agree the CFPA is the wrong approach.

According to the Chamber, this new agency would have authority to regulate a significant swath of the business community—including nonfinancial businesses that had nothing to do with the economic crisis and little to do with consumer finance. Even orthodontists and others that allow their customers to pay over time could find themselves subject to new and costly regulations. The CFPA would also create needless duplication with both federal and state regulators. And the lack of effective coordination with other regulators would hurt consumers. Additionally, the Chamber’s education campaign has generated more than 220,000 letters opposing the CFPA.

“There are obvious concerns with the unprecedented authority a single director of the CFPA would have under the Senate plan,” Hirschmann said. “Americans want checks and balances factored into consumer protection, and they believe that a bipartisan commission is the best path forward. They also know that financial reform is too important to ram-through without broad consensus and without studying its impact on consumers and small businesses.”

The U.S. Chamber has long called for modernizing our financial regulatory system to protect consumers, help ensure abundant, affordable access to capital for individuals and businesses, and provide new economic growth to help create millions of jobs. The Chamber has proposed a Consumer Protection Commission to coordinate regulatory and enforcement actions, eliminate gaps, provide consistent disclosure standards, and identify areas in which new regulations are necessary.

“We agree that Americans need someone on their side when it comes to consumer credit,” said Hirschmann. “Americans also need someone on their side to create jobs and protect the economy—our plan does all three. It’s been 75 years since we last overhauled financial regulations. There is still time to fix the flaws in this bill and get financial reform done right, if our leaders can set politics aside and listen to the American people.”

Since its inception three years ago, the Center for Capital Markets Competitiveness has led a bipartisan effort to modernize and strengthen the outmoded regulatory systems that have governed our capital markets. The CCMC is committed to working aggressively with the administration, Congress, and global leaders to implement reforms to strengthen the economy, restore investor confidence, and ensure well-functioning capital markets.

The U.S. Chamber of Commerce is the world’s largest business federation representing the interests of more than 3 million businesses of all sizes, sectors, and regions, as well as state and local chambers and industry associations.

# # #