By Bill Conerly, Conerly Consulting [5], Businomics [6],

More interesting information from the IMF’s World Economic Outlook [7]:

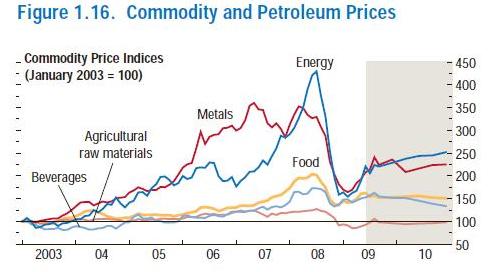

Before getting to the outlook, note some of the dynamics. The mildest cycle was for agricultural raw materials, followed by beverages (coffee, tea) and food. These are generally materials with rapid supply response to rising price. You want more coffee? Plant more bushes. Metals has a a much longer response time, as you prospect for ore, build or expand mines, increase refining capacity, and perhaps wait for ore-carrying ships to be built. Oil has the longest response time.

The outlook? We’ve had quite a bounceback, and stronger global economic activity should be positive for prices. But don’t forget that we’ll continue to have new production capacity coming on line for energy and metals. Those long time lags of supply response mean that we’ll have greater supply in 2010 because of the high prices in 2007. As a result, I forecast only moderate growth of commodity prices.