May Forecast Brings More Revenue, Little Clarity

Since February, May 16 has been circled on Legislative calendars as the day budget talks would turn the corner and head down the stretch. The last forecast before the end of the 2017 Session would provide clarity, telling Legislators how much money they could spend in the next biennium. In particular, it would indicate whether revenues had exceeded projections enough to trigger “kicker” refunds to taxpayers.

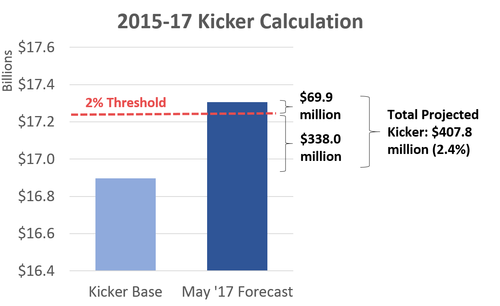

As it turned out, the forecast probably raised as many questions as it answered. Economists currently project a kicker of $408 million. Even with a kicker, the state still will have $187 million more than originally projected, reducing the gap between the cost of current services and expected revenues to $1.4 billion.

News of the reduced budget gap and likely kicker deflected attention from other aspects of the revenue forecast. These points deserve Legislators’ attention:

- Even though the economy and revenues are growing faster than projected, the state still faces a budget gap.

- Even though revenues exceeded previous forecasts, job and revenue growth are slowing down. Also, the state remains vulnerable to potential shifts in federal policy and global economic conditions.

- Even though discussion about tax reform often has focused on boosting corporate taxes and increasing revenue stability, corporate taxes are stabilizing.

- Reserves are projected to increase to about 10% of the budget by the 2019-21 biennium. The increase in reserves is some of the best news in the forecast. One danger from this forecast is that it could provide a path for Legislators to piece together a 2017-19 budget and ignore long-term problems. That would be a mistake. “One of these days there’s going to be a recession and it will blow a hole, most likely, bigger than the structural one we’re dealing with now,” said State Economist Mark McMullen.

Legislators can’t afford to ignore the warnings that lie beneath the headlines of the revenue forecast. If Oregon struggles to balance a budget during the best of times, it’s scary to imagine what will happen during the worst of times. And no approach to tax reform will work without tangible steps to slow expenses such as pension and health care costs that grow faster than revenues under all types of economic conditions.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.