![]()

By Josh Lehner

Oregon Office of Economic Analysis Blog

Among the myriad economic trends to watch in 2016, two in particular stand out to me: labor force participation and middle-wage jobs. The reason is both have turned the corner in recent years — even if the conventional wisdom about them has not — and they’re indicative of the growing breadth or coverage of the expansion, something that was clearly missing in the early years of recovery. The good news is the new year should bring continued improvement for both measures of the economy.

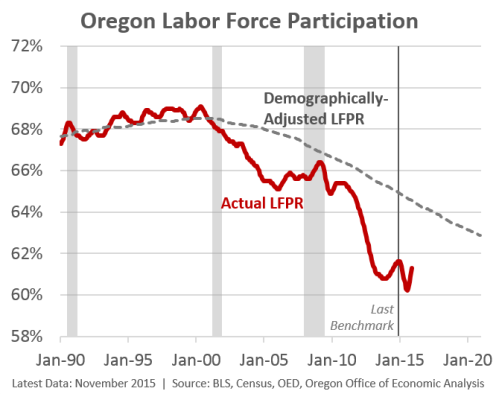

First, labor force participation, which is important but can be misleading. It’s important because more workers, or more potential workers can raise the overall productive capacity of the economy, generating stronger growth. Conversely, fewer workers can shrink the capacity of the economy. However the massive demographic shifts in the U.S. and in Oregon are driving much of the underlying participation trends, which you cannot do anything about in the short-term. The LFPR is essentially at its lowest point in recorded history with data going back to the 1970s. However, given the demographics, the LFPR should be at its lowest point, or close to it. What matters from an economic perspective is what our office has been calling the participation gap — the difference between the demographically-adjusted LFPR and the actual LFPR.

The household survey has been noisy in 2015, to put it nicely. However, given that job gains continue to outpace population growth, and is expected to continue to do so for at least 2016, our office expects some continued improvement in LFPR, including revisions to the 2015 data. We are not looking for a robust rebound, but about a 1 percentage point increase over the next year – part of the labor force response. As the demographically-adjusted LFPR is falling by 0.4 percentage points per year, this combination will cut Oregon’s participation gap nearly in half by the time 2017 comes around. The gap will still exist — in fact our baseline forecast does not have it fully closing as some of the Great Recession damage is likely permanent — but comparable in size to the gap back in 2007. (See here for more on Oregon’s LFPR.)

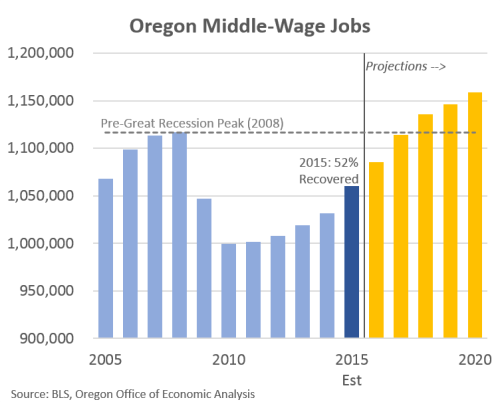

The second important trend to watch in 2016 is the growth in middle-wage jobs. Broadly speaking this includes occupations that pay roughly $30-50,000 per year — based on our office’s job polarization research (HERE & HERE, e.g.) — and represents the middle part of the income distribution, and employ roughly 60 percent of Americans and Oregonians. This group entails most blue collar occupations like truck drivers, plumbers, construction and production workers in addition to white collar ones like office support staff, sales teams, teachers and community service workers.

Middle-wage jobs accounted for more than 8 out of every 10 lost jobs during the recession. While both high- and low-wage jobs are currently at historical highs in terms of employment, middle-wage jobs are not. In fact they have recovered just about half of their recessionary losses. However growth has returned and appears to be accelerating a bit. We’ll have to wait a few more months for the official 2015 data, but rough estimates based on mapping industry data back to occupations shows sizable gains in Oregon this past year.

Even as it appears 2015 was actually a good year for middle-wage jobs, our office does not expect them to fully regain their recessionary losses until 2017. Much of the growth in recent years has been more on the white collar side, as the blue collar occupations experienced larger losses and fewer gains. However, construction is now on the upswing, along with the housing market.

In our original report, our office discussed the drivers of middle-wage jobs. Some are driven largely by population growth. As migration flows have returned to Oregon and household formation increases, so too does the demand for housing, home repairs, health care, entertainment, teachers, and community services. The uptick in population growth bodes well for these middle-wage jobs in the near term.

The second group of middle-wage jobs can broadly be considered as business support occupations. From the report:

Administrative Support, Sales and Transportation all act as suppliers of labor and services to other businesses or employees. With increases in business operations, including headquarters, the demand for such occupations will increase even if technological advancements continue to eliminate a portion of these jobs. This provides an opportunity for continued investment into activities that foster both an entrepreneurial business climate and also recruitment and retention efforts of existing firms. The loss of significant headquarter operations in Oregon over recent decades has decreased the demand for some of these business support firms and workers.

All told, the outlook for the number of middle-wage jobs in Oregon is relatively bright today. However, over the longer term the relative share of jobs is expected to continue to decline as high- and low-wage jobs see stronger growth.

Disclaimer: Articles featured on Oregon Report are the creation, responsibility and opinion of the authoring individual or organization which is featured at the top of every article.