[5]

[5]![]() [6]

[6]

By Josh Lehner

Oregon Office of Economic Analysis Blog [7]

The Oregon Office of Economic Analysis released the latest quarterly economic and revenue forecast. For the full document, slides and forecast data please see our main website [8]. Below is the forecast’s Executive Summary.

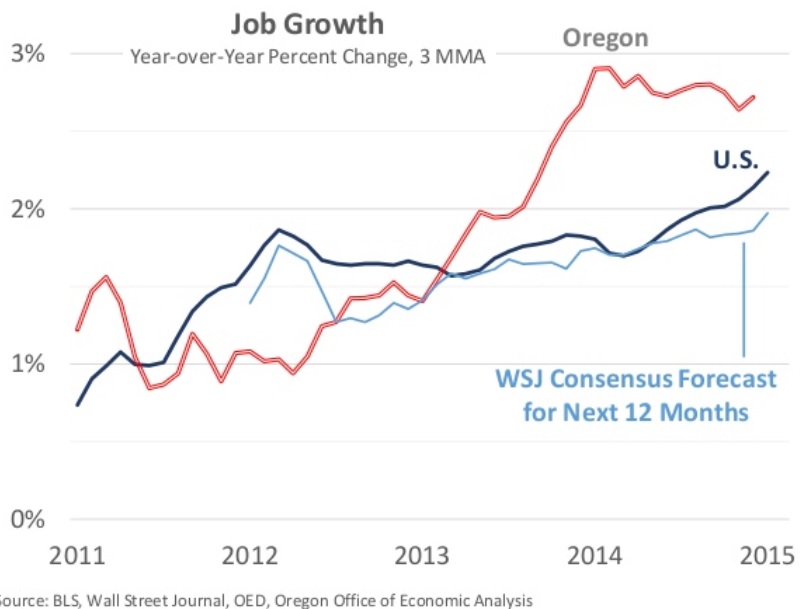

With each passing month, it is becoming more evident that the U.S. economy is finally emerging from the aftermath of the Great Recession and financial crisis. In particular, the labor market is reaching near-boom levels of job growth. Such gains are not only strong enough to keep up with population growth but are also drawing more workers into the labor force, as these individuals seek out one of the now-plentiful job openings. The combination of job growth acceleration, solid economic output and the impact from substantially lower energy prices has the typical economic forecaster more optimistic today than any other time in recent years. Taking stock of 2014 reveals a surprisingly solid economic year. 2015 is expected to be even better. While the longer-term growth prospects of the economy remain below previous expansions, primarily due to the aging workforce, it does not rule out a year or three of good growth in the near term.

While the nation’s labor market acceleration began only recently, Oregon’s recovery picked up considerably in 2013. The stronger pace of growth was maintained throughout 2014 and is expected to continue this year and next before demographics weigh on longer-run growth. Today, Oregon still lags the typical state relative to pre-Great Recession levels. However Oregon has regained its traditional growth advantage in expansion and is making up lost ground. More importantly, signs of a deeper labor market recovery are evident in the state. Unlike in the nation as a whole, strong job growth is bringing real wage gains to Oregon. Not only is the labor force growing with more Oregonians looking for work, but the labor force participation rate itself increased throughout 2014. The key question is whether or not Oregon can take another step up in growth, to rates seen during the typical Oregon expansion. All told, Oregon is approximately halfway back to full employment with the current pace of improvement considerably faster than the nation as a whole.

Oregon’s General Fund revenues have grown at a rapid pace in recent months driven by a healthy job market together with solid growth in taxable investments and business income. In particular, advance payments of 2014 personal income taxes have been very strong in recent weeks, outstripping the December forecast. These large advanced tax payments suggest that taxpayers expect to face large tax liabilities when they file in April.

Despite strong recent collections, overall General Fund revenues still closely match the Close of Session forecast that was used by the legislature when crafting the 2013-15 state budget. Although revenues have mirrored the Close of Session forecast to date, the end of the biennium is likely to be stronger than was expected when the budget was built. An increasingly strong outlook for April 2015 tax payments, combined with revenue increases enacted during the 2013 Special Session, together suggest that 2013-15 biennial tax collections will wind up near or above the 2% personal income tax kicker threshold.

The March 2015 outlook assumes that revenues included in the personal income tax kicker base will exceed the kicker threshold by $59 million at the end of the biennium. Should this outlook hold true, a personal income tax kicker of $349 million will be issued. Due to actions taken by the 2011 Legislature, this potential kicker payment will take the form of a credit on 2015 tax returns rather than being issued as a check at the end of the year.

Although a kicker payment is now the most likely outcome, there remains the distinct possibility that the kicker will not be triggered during the current biennium. There is still around $4 billion of kicker-related revenue yet to come before the biennium ends in June. If these collections fall just 2% below expectations, the kicker threshold will not be reached.

If the March 2015 outlook comes to pass, and a kicker is triggered, it will not fundamentally change the task faced by legislative budget writers during the current session. Most of the reduction in 2015-17 income tax collections due to the kicker will be offset by larger balances heading into the biennium together with improved prospects for the regional economy over the next two years.

For the full document, slides and forecast data please see our main website [8] or view our presentation to the Legislature below.